When I wrote about Chat GPT in December 2022 I described it as an indicator of the massive impact artificial intelligence is going to have a on how knowledge workers and others work. The events of the past three months have only reinforced that view.

How accounting firms are using Chat GPT

I have discussed Chat GPT at every opportunity with firms individually and in groups over the past few months because I believe it brings many opportunities for firms. There are some challenges and threats too and if you haven’t already read my first article now would be a good time to revisit it before you go on. Why accountants should pay attention to ChatGPT – Planet Consulting As leaders of accounting firms I believe it is important to have a good awareness of what’s going on in this space because it will have a profound impact on how we work.

Here are some of the ways firms are already using ChatGPT:

- Helping team members (particularly English as a second language team members) write better emails or documents

- Clearing writers block by giving suggestions on a topic

- Replacing a well known reference service in guiding users to tax legislation (I’m not sure this is wise at this stage but this firm is happy with it for that)

- Writing blogs and marketing documents

- Writing tax advice drafts that can provide a good starting point

- Writing code for software apps

- Writing formulae for Excel

- Summarising documents, including for training

The common theme with its use is that it is a tool to assist a human worker work both more effectively and efficiently.

If you are using it in other ways I’d love to hear from you.

Have a policy that guides its use

I think it’s clear that best practice now is to have a policy in place that guides how tools like Chat GPT should be used in firms. Most firms have landed on forbidding the entry of anything could identify a client and also any firm sensitive information. This a relatively new tool and we don’t really yet understand how any content is stored and managed and where it might potentially end up. Take some advice from your technology support company, but I’d be surprised if they were not suggesting great caution.

Keep an eye on developments, including from other providers

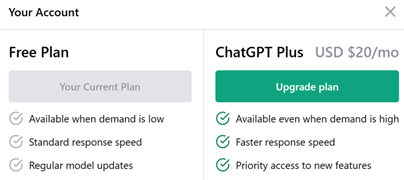

Since the initial release in November 2022 of a free version (3.5) there is now a subscription version and an updated version called GPT-4. This new version can interpret images as well as text and as I understand it has some other enhancements. The only way to access GPT-4 is through a USD20 per month subscription to ChatGPT Plus. See a screenshot from the OpenAI website explaining the difference between the free and subscription access.

See more about GPT-4 here: OpenAI

Another way to access GPT-4 capability plus more potentially, is through Microsoft’s Bing Chat. It has the same abilities of ChatGPT but has full access to the internet, which ChatGPT does not have. There is a waitlist for access to this.

The other thing to remember is that Chat GPT may not be the only game in town. There was a recent article in the AFR which referred to a number of potential competitors to Chat GPT including:

- Stability AI

- Anthropic

- AI21Labs

- AI

- Cohere

- Amazon Web Services

- Baidu

I’ve not looked at any of these yet.

Take note of what is happening in the legal profession too

In many ways the lawyers have been ahead of accountants in using these sorts of tools. Richard Susskind is a UK expert in this area and a person whose views I greatly respect. Have a read of a recent article he wrote for the UK Times:

How artificial intelligence will shape the future for lawyers (thetimes.co.uk)

Richard and his son Daniel have been deep thinkers abut this stuff for many years and in 2016 I did a review of their book the Future of the Professions. It seems to me that some of their predictions are coming to fruition. Book Review – the Future of the Professions -How Technology Will Transform the Work of Human Experts – Richard and Daniel Susskind – Planet Consulting

Have a play

I’ve included below the answers to a couple of accounting firm questions I posed Chat GPT and got pretty credible answers for. I’ve also started playing with it for ideas and tangible help in planning more travel. Jump online and have a play and encourage you team to do the same. I’m convinced we are going to find all sorts of amazing ways to use it.

Here is the answer Chat GPT gave when I asked how it could be used in accounting firms:

Possible Uses of Chat GPT in an Accounting Firm

Chat GPT, or Generative Pre-trained Transformer, is a type of AI language model that has been gaining popularity in recent years. It is a machine learning tool that can generate human-like text based on a given prompt, making it ideal for various applications, including customer support, content generation, and more. One area where Chat GPT can be useful is in an accounting firm. In this article, we will discuss the possible uses of Chat GPT in an accounting firm.

Automating Data Entry and Analysis

One of the most tedious tasks in an accounting firm is data entry and analysis. It can take a considerable amount of time and resources to input and analyze data, especially if there is a large volume of it. Chat GPT can be used to automate this process. With its ability to generate human-like text, Chat GPT can be trained to recognize patterns and generate reports based on financial data. This can help accountants save time and focus on more important tasks like analyzing the data and making strategic decisions.

Enhancing Customer Service

Another possible use of Chat GPT in an accounting firm is to enhance customer service. Chat GPT can be integrated into the firm’s website or customer portal, allowing customers to ask questions and receive quick responses. This can be especially useful during the tax season when customers have a lot of questions about their taxes. Chat GPT can provide accurate and timely responses to common questions, freeing up accountants’ time to focus on more complex inquiries.

Generating Financial Reports

Chat GPT can also be used to generate financial reports. With its ability to generate human-like text, Chat GPT can be trained to create reports based on financial data. This can help accountants save time and resources, as they no longer have to spend hours creating reports manually. Additionally, Chat GPT can generate reports that are easy to understand for non-financial professionals, making it easier for clients to understand their financial standing.

Fraud Detection

Fraud detection is a crucial task for accounting firms. Chat GPT can be used to analyze financial data and detect patterns that could indicate fraudulent activity. Chat GPT can be trained to identify red flags and notify accountants of potential fraud, allowing them to take action before it becomes a more significant problem.

Predictive Analytics

Predictive analytics is another area where Chat GPT can be useful in an accounting firm. Chat GPT can be trained to analyze financial data and predict future trends, allowing accountants to make informed decisions. This can help accountants to stay ahead of the curve and make strategic decisions based on accurate predictions.

In conclusion, Chat GPT has a wide range of possible uses in an accounting firm. From automating data entry and analysis to enhancing customer service, generating financial reports, detecting fraud, and conducting predictive analytics, Chat GPT can help accountants save time, resources and make more informed decisions. As AI technology continues to evolve, it is likely that more applications of Chat GPT will emerge, making it an increasingly valuable tool for accounting firms.

And here is another query I entered:

I’m starting an accounting firm. What are the keys to a successful accounting firm?

Starting an accounting firm can be a challenging but rewarding experience. Here are some keys to a successful accounting firm:

Establish a clear vision and mission

Before starting your accounting firm, it’s important to have a clear vision of what you want to achieve and a mission statement that outlines your values and goals. Your vision and mission should be aligned with the needs of your target market and set the tone for the type of services you provide.

Build a strong team

Your team is the backbone of your accounting firm, so it’s important to hire the right people with the right skills and values. Look for team members who are passionate about their work, have excellent communication and interpersonal skills, and are committed to delivering high-quality services to clients.

Provide exceptional client service

Client service is the cornerstone of any successful accounting firm. Make sure to go above and beyond to meet your clients’ needs and expectations. Be responsive, proactive, and transparent in your communication and provide personalized solutions that fit their unique needs.

Stay up-to-date with technology

Technology is an essential tool for modern accounting firms. It can help streamline your workflow, improve efficiency, and provide better insights into your clients’ financial data. Stay up-to-date with the latest accounting software, cloud-based solutions, and security measures to ensure your clients’ data is protected.

Build strong relationships with clients and partners

Building strong relationships with clients and partners can help you grow your accounting firm and increase your referral base. Take the time to understand your clients’ businesses, goals, and challenges and provide value beyond traditional accounting services. Network with other professionals in your industry and build partnerships that can benefit your clients.

Continuous learning and improvement

Continuously improving your skills and knowledge is essential to staying relevant in the accounting industry. Stay up-to-date with changes in tax laws and regulations, attend training and development courses, and seek feedback from your clients to identify areas for improvement.

Starting and growing a successful accounting firm takes time, effort, and dedication. By focusing on these key areas, you can build a strong foundation for your business and set yourself up for long-term success.