For Australian accountants 15 May is a significant date. As Tax Agents you are subject to the ATO’s lodgment program framework which at its core requires you to lodge 85% or more of your clients’ current year returns on time. 15 May 2019 is effectively the last date for lodgment of 2018 Income Tax returns, with a few exceptions.

For Australian accountants 15 May is a significant date. As Tax Agents you are subject to the ATO’s lodgment program framework which at its core requires you to lodge 85% or more of your clients’ current year returns on time. 15 May 2019 is effectively the last date for lodgment of 2018 Income Tax returns, with a few exceptions.

I meet firms who are all over this and it is never an issue, while some others struggle.

The ATO calculates the percentage of on time lodgments as follows:

For Income Tax = (Current year returns lodged by due date + Current year returns by deferred due date + Return not necessary advices + Further return not necessary advices) ÷ Your client list = % lodged on time.

For Fringe Benefits Tax = (Current year returns lodged by due date or deferred due date + Notice of “non Lodgment” Advice + Registration Cancellation Advice) ÷ Your client list = % lodged on time

See the ATO guidance here: https://www.ato.gov.au/tax-professionals/prepare-and-lodge/lodgment-program-framework/85–on-time-lodgment-requirement/how-we-calculate-your-lodgment-performance/

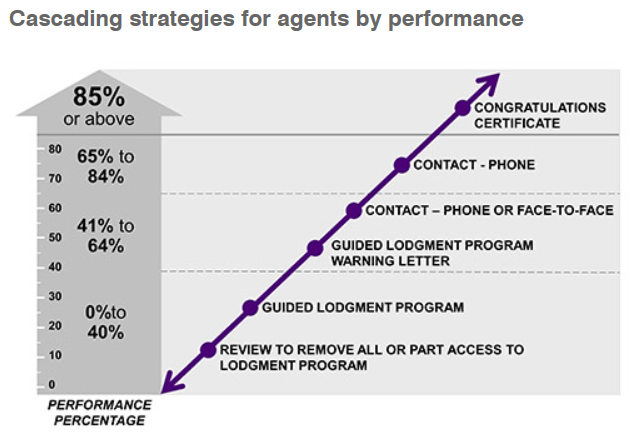

The ATO publishes this diagram to show how they will deal with you if you do not make the 85% requirement:

See some further explanation from the ATO here: https://www.ato.gov.au/tax-professionals/prepare-and-lodge/lodgment-program-framework/if-you-do-not-meet-the-performance-requirement/

Here are my suggestions to ensure you are ready for 15 May:

- Have a close look at your client list as provided by online the ATO.

If it is not correct, make sure all adjustments are processed with the ATO.

It is not unusual to hear of a firm that was unnecessarily penalised because ex-clients were still on the list. Don’t let that be you. - Makes sure all return not necessary advices have been lodged.

These should be easy, so long as you know which clients they apply to. - Review what has not been yet lodged to identify any outliers.

For example if you had problems in prior years with particular clients you may need to be more proactive in following them up and making sure you have everything you need from them. You probably should have done this some time ago, but better late than never. I’ve noticed some firms having great success with this approach and noting that clients are usually quite happy to be chased. They see your proactivity in this regard as a positive thing and see you have their best interests in mind. - Pay special attention to SMSFs

It is well known that various changes to SMSF regulation have put considerable pressure on accountants to get work completed. My understanding is that some of the changes are complex and can have a significant impact on funds if you get it wrong. So make sure someone in your firm is on top of the changes and you are proactively working with clients to get the best outcome. - Assess capacity

If you need to ask for extra hours from your team, it probably should have been planned some time ago, but if a review of returns still to be completed versus available capacity indicates “all hands on deck” is needed then get that in place quickly. Manage team expectations about what is required for the next month and how you will reward them for the extra effort. - Get third party help if necessary

Some firms have contractors they call on to assist in busy times.

If you don’t have such people, consider using someone like Connect Outsourcing http://connectoutsourcing.com.au/ or CleverFox Consulting cleverfoxconsulting.com.au - Keep a close eye on progress

Between now and 15 May monitor progress closely and make sure the reporting is accurate.

Don’t be complacent and be proactive in chasing up clients if they are holding you up. Do whatever it takes to get returns completed. - Celebrate when you get there!

Acknowledge a job well done then review what worked well and what you will do differently for next year.

What to do if you are experiencing difficulties in meeting the program

If you have followed the steps above and are still struggling the ATO says they will help, particularly in cases of:

- Serious illness within your practice or family

- Sudden and unexpected staff changes

- Natural or other disasters

In such instances they will help you with a “managed lodgment program” but there are some conditions, the two most important being:

- Your own taxation obligations must be kept up to date

- You must take reasonable action to attempt to resolve the issues that have caused you to fall behind with your lodgments

See more on this here: https://www.ato.gov.au/Tax-professionals/Prepare-and-lodge/Managing-your-lodgment-program/Help-with-your-lodgment-program/

One final tip

Get on the front foot for next year. In June or July communicate with your business clients, SMSFs and significant individuals to schedule when their work will be done. And for others remind them of the importance of not leaving to the last week or two because if they do you cannot guarantee the right outcome for them. If you can educate your clients and shape their expectations, you will have a stress free 15 May and a less lumpy flow of work.